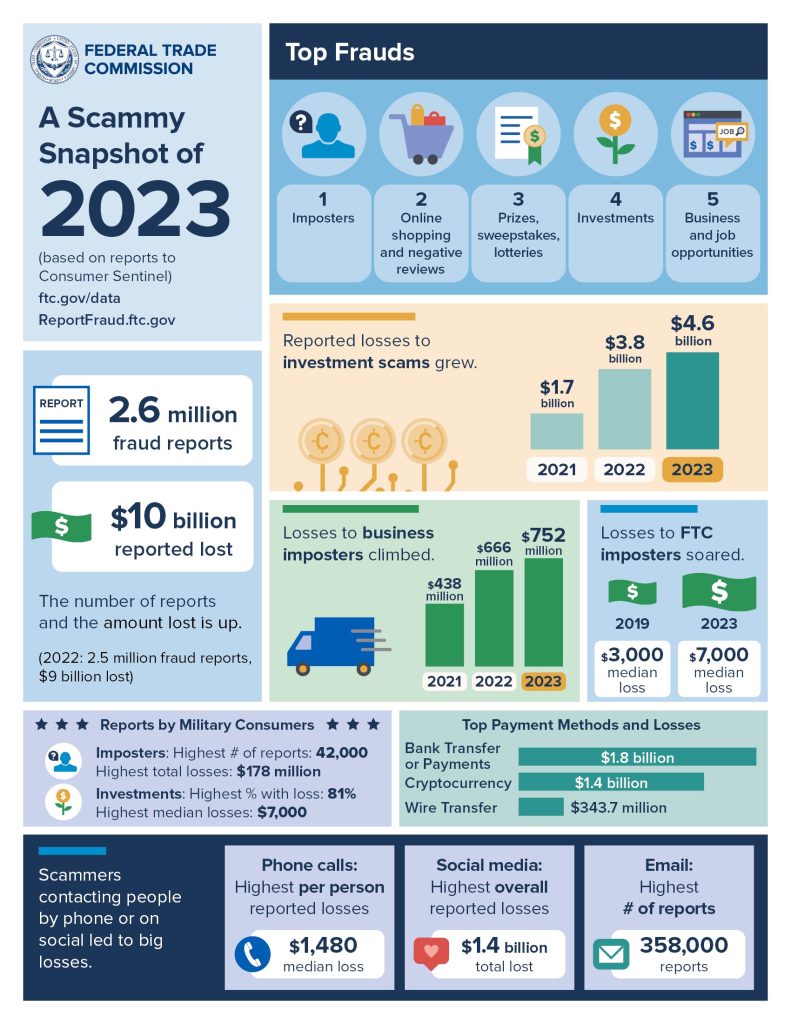

In 2023, Washington residents lost over $253 million to fraud, according to Federal Trade Commission (FTC) data. Nationwide, 2023 fraud numbers were even more sobering: Americans cumulatively lost more than $10 billion.

There’s no shortage of ways in which to be scammed these days, from suspicious emails posing as your bank, a service provider or even a prince to innocent-seeming text messages and phone calls. Pair this with the increasingly convincing use of technologies like artificial intelligence and voice-cloning, and it’s no surprise that many people fall for scams.

Fortunately, Peoples Bank provides plenty of ways to educate yourself about fraud prevention and protect your finances against everything from banking fraud to phishing scams.

Many Ways to Deceive

There are many types of scams someone can fall for. Renee Naidu, VP, Deposit Operations Director at Peoples Bank, says the most prevalent scams people fall for are those involving “social engineering” or personal attempts to engage a potential victim.

It may start with a fake text message claiming to be your bank or making initial contact with the seeming innocence of having contacted the wrong phone number.

“They find a connection and then use that to evolve the conversation into sending money,” Naidu says.

The most nefarious method of doing this involves playing the long game, Naidu adds. A scammer may build up a relationship off an initial “sorry, wrong number” text, building a level of misplaced trust before asking for money.

“It can be really elaborate,” she says. “They play it very slowly, and they’re willing to get to know their mark, starting with even a simple greeting. Then, they’ll let it drag out for months and slowly rob them blind.”

Often, these asks might be towards an investment opportunity in real estate or cryptocurrency. FTC data shows investment scams are particularly successful: consumers lost more than $4.6 billion – more than any other type of scam – in 2023, up 21% from 2022. Money lost to bank transfers and cryptocurrency scams in 2023 exceeded all other methods combined, according to the FTC.

“We have seen someone lose significant amounts of money because they believed the person on the other side [of the phone] was doing investments with them,” Naidu says.

How to Spot a Scam

There are many things you can do to discern the legitimacy of a message or request.

Naidu says to always be mindful of a message’s urgency and if they’re asking to input passwords or other sensitive credentials to further a process. It’s also helpful to take notice of an email’s actual “sent from” address and the area code of texts and calls. If a text claiming to be your Washington bank has a Florida area code, that’s a red flag. If the IRS is contacting you by phone, it’s not the IRS; they traditionally contact taxpayers by mail.

If a suspicious contact is asking for cash, such as through PayPal or even through the mail, that’s another warning sign.

“Asking for cash is a huge red flag,” Naidu says. “Nobody legitimate would ask you to take cash to an ATM or to a money-service provider to get them payment.”

Similarly, no legitimate entity is going to insist on being on the phone with a victim while they are in the process of committing fraud. Some scammers are known for acting threatening or intimidating, especially to the elderly, Naidu says.

Even when your bank does reach out, asking if you made a particular transaction because fraud on your account is suspected, those messages will never ask you for money or give an elaborate set of instructions. Normally, confirmation of suspected account fraud results in your bank card being frozen to discontinue access by whoever has infiltrated your account.

When in doubt about a potential scam, Naidu always says to check things out with those you trust, whether it’s your bank, a utility provider, or a software company. Call or visit your local office, and do not respond to the suspicious message you’ve received.

“Always reach out to a contact that you know,” she says. At Peoples, that can be a bank employee, contact info found on your bank statement, or the phone number written on back of your bank card.

Even if fraud is not directly related to your bank, Naidu says to always notify your bank if financial information may be exposed elsewhere.

“There are things that you may not realize could be impacted,” she says. “If you find out there’s fraud based on unauthorized internet provider account access, you don’t know how much information they got from that access.”

In other words, be transparent, she adds: the bank can’t help if they don’t know what’s going on.

Other Resources

While Naidu points out that there isn’t currently a centralized database to report potential spam and scam phone numbers, pending legislation may one day force phone service providers to hotlist the numbers that scammers are using.

Several government agencies have plenty of links and resources, however, to help you if you fall for a scam. These include websites like consumer.gov, which provides a step-by-step guide based on the particular type of scam you’ve fallen for.

Likewise, the FTC has numerous resources for dealing with fraud, including a reporting process and several tools that train people what to watch out for. Peoples Bank also has a helpful webpage full of information and educational material.

With these tips in mind, any potential scammers you come across will hopefully wind up in the same place: out of luck, and away from your wallet.

Sponsored